What credit rating want to qualify for home financing after all? The specific score you may need utilizes the mortgage program, but generally speaking, you could be eligible for extremely mortgage loans having good 620 credit history or even more.

Specific mortgage software, for example authorities-backed choice and additionally regarding You.S. Government Homes Government, Farming Department and you will Agencies regarding Veterans Things financing, support lower fico scores. Since the Bane teaches you, Those can be more versatile with the credit history.

**That have FHA funds, individuals is technically enjoys ratings as low as 500.** Private lenders that make brand new finance normally require high score and you may very perform. Skyrocket Financial, eg, requires at least a beneficial 580.

Most of the loan differs, Maguire-Feltch states. There’s no single, certain credit history that immediately qualify you to possess a mortgage.

Points Past Credit rating

**Your credit rating performs a choosing role with what home loan rates you get, but it’s perhaps not the actual only real basis loan providers envision.** The debt-to-income proportion-otherwise how much cash of one’s monthly earnings goes toward personal debt costs-is even very important.

**Increased ratio looks so much more risky to help you lenders since it means you would reduce currency left having home financing commission, shortly after almost every other monthly debt obligations is met,** Maguire-Feltch says.

How big is your advance payment and facts when you look at the. Huge down money suggest the lending company have faster on the line if you fail to help make your costs, so they really often render a lowered speed. Quicker off repayments increase the lender’s chance and certainly will perform the contrary.

Fundamentally, the lender you decide on matters, too. As all business possesses its own functional capability, income or any other unique criteria, it charge different costs and costs.

You to definitely studies of the Freddie Mac found that cost provided by various other lenders varied up to 0.60 percentage facts to own an individual debtor-the difference between an effective 6.4% price and an effective seven% you to definitely (or about $140 a month on the an excellent $350,000 mortgage).

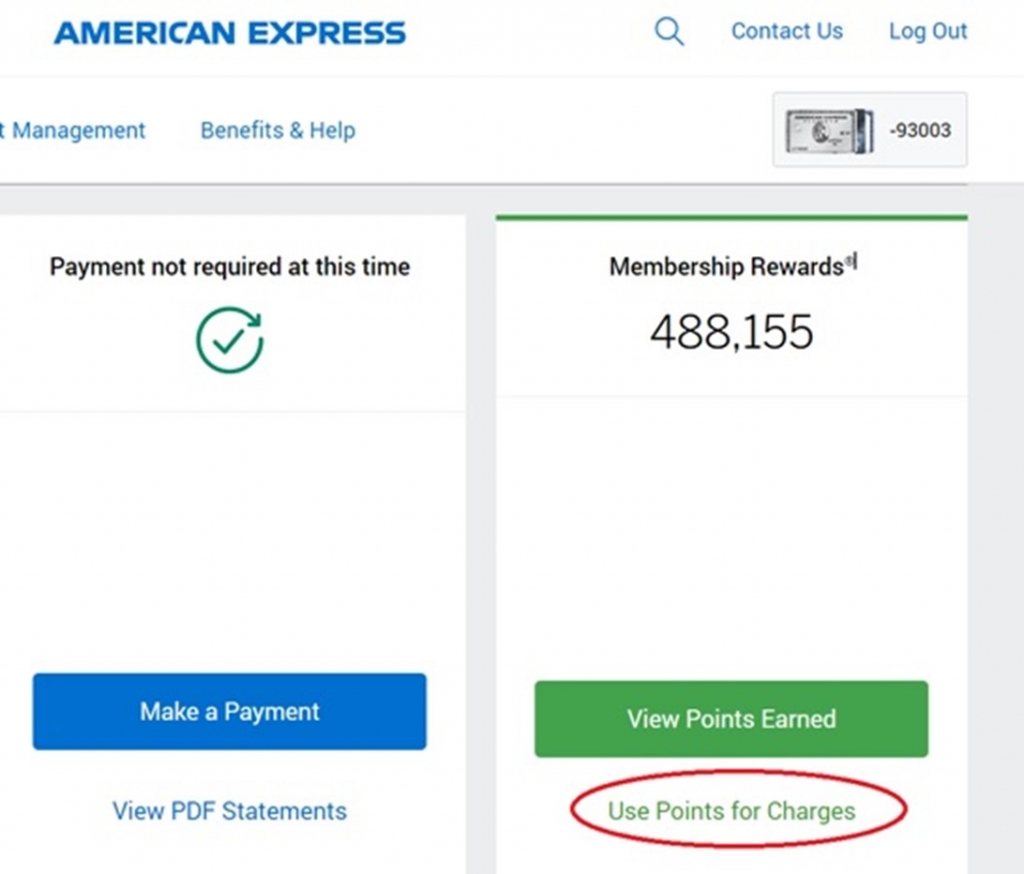

To get your credit score, look at the financial otherwise charge card dash when you yourself have that. Of many have automated credit rating keeping track of, letting you look at your get when.

**Merely bear in mind and that rating they’ve been demonstrating your.** Officially, you truly need to have the scores throughout the three biggest credit bureaus-TransUnion, Equifax and you may Experian-to discover the most specific picture.

Should you have a great TransUnion get out of 730, a keen Equifax get regarding 745 and an enthusiastic Experian get of 715, such as for instance, lenders can use 730-the midst of people score-so you can meet the requirements you having loan applications and put their rate.

While you are using which have another person, together with your mate or a close relative, lenders will always grab the low of the two center ratings ranging from you (otherwise, on the particular financing, the typical of your a couple of middle results, while on the https://paydayloancolorado.net/acres-green/ cusp from being qualified).

Whether your lender merely shows you one of these scores, you should buy the rest directly from the financing bureaus to own a little payment. Just be sure you will be purchasing the get and not only a standard credit report. Very first credit reports merely is details about the levels and you can payment history-not results.

Strategies to evolve Your credit score

There are many an easy way to change your credit rating-particular simpler than you possibly might thought. Below are a few strategies that can assist:

- Make with the-time repayments: Stop later costs-including towards figuratively speaking, handmade cards and other style of expenses which get advertised to credit bureaus. In some instances, other stuff, also overdue portable expenses and you may resources, will even impression the rating-yet not usually.

- Beat exactly how much borrowing from the bank you may be playing with: Slow down the balances you go on your own lines of credit-if at all possible so you can 30% of your own total personal line of credit or quicker. When you yourself have an effective $10,000-maximum credit card, such as, you would want to lower your balances in order to just about $step three,000.