Precisely why you you will imagine introducing collateral

The most common reason individuals and couples choose to launch guarantee will be to make old age warmer. The cash may help you which have monetary planning senior years to help you retire very early, tick things of their bucket listing if not pay outstanding bills from inside the later on lifestyle.

A different popular reason behind establishing guarantee should be to render every or some of the money to a family member. In recent years, this is done to help the partner get its own property.

What happens if the family cost slide?

The security launch be sure suppress guarantee discharge company out-of asking for more income than are elevated from the product sales of the house.

If home costs fall additionally the resident is within bad security, meaning it owe more about the newest collateral discharge loan than simply its house is really worth, they don’t have to pay any thing more compared to income rates.

Whatever else from inside the home, particularly discounts, need not be used to repay the lender, neither do the beneficiaries of your own would need to spend the money for financial the fresh shortfall.

Just how much do you really pay-off towards equity launch?

The amount you only pay right back immediately following having fun with a collateral release plan is dependent upon for many who used property reversion program or a lifetime home loan.

That have a property reversion design, the organization gets a price equivalent to the display of your property it now very own. Including, when they own fifty% of the property, they’ll get fifty% of your currency raised on the income of the house.

Because zero attention are extra, extent due is easy. Yet not, these businesses will make notably lowest proposes to be sure profits actually whether your domestic worthy of provides decreased.

Which have a lifestyle financial, the amount you have to pay back on your own security release package tend to depend on around three circumstances, namely:

- The fixed rate of interest you wanted to

- The time elapsed involving the beginning of the home loan and when your die or enter into a lot of time-label worry

- The amount of money released

For example, taking right out an existence financial regarding ?65,000 in the a fixed interest out of 6.4% more than 12 ages do equal a whole financial obligation off simply lower than ?137,000. Even when your debt is collect fast, it is essential to keep https://paydayloanalabama.com/calera/ in mind that you could potentially never ever are obligated to pay more than the worth of the home when the selling of your house is completed.

Collateral Discharge Analysis

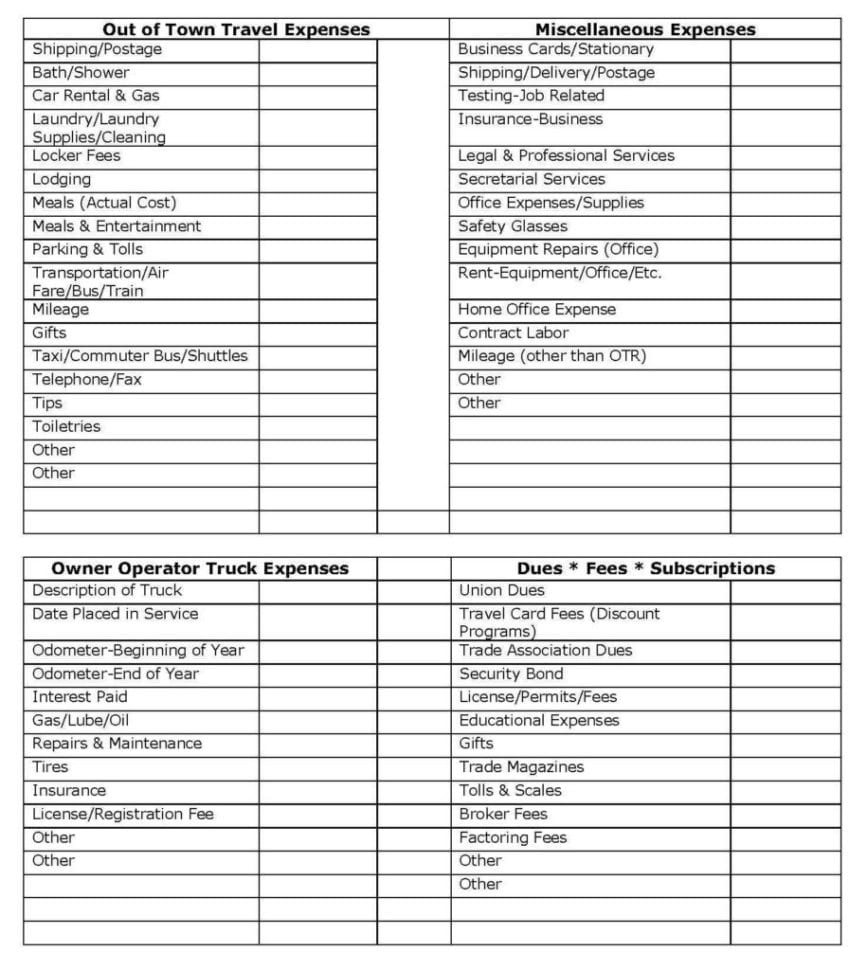

We make it dining table so you’re able to top comprehend the differences between a property reversion plan and you will a lives financial.

If you would like learn more about these types of security release versions and how they could apply to their youngsters’ inheritance, definitely understand the detail by detail book.

Do you have to spend taxes?

The money you will get out-of security release isnt at the mercy of taxation or Financing Growth Tax (CGT) 2 . Just money you receive off a job or earnings while the a self-employed just individual is actually subject to taxation. And you may Financing Progress Income tax are placed on winnings once you sell a valuable asset, such as a property.

Obviously, the previous cannot incorporate, but why do you not need to pay CGT towards the security launch? The clear answer is you have not offered your residence.

Although it may feel such as promoting your home and ongoing so you’re able to are now living in it, exactly what has taken place is that you have taken away a loan facing certain otherwise all the possessions. Funds from funds isnt susceptible to any United kingdom income tax.

Discover the possibility that releasing equity and you can gifting the bucks so you’re able to someone can aid in reducing genetics taxation (IHT). But not, this really is high-risk and might never be beneficial total.