- What does a lender have a look at from inside the a standard financial application?

The content could have been featured by a minumum of one Examine Club professional. That it evaluate offers believe you to definitely everything discover here is the highest quality blogs backed by the ExpertEase.

A long time ago, inside the a lending land at a distance, I worked because the a mortgage broker. Most of the now and then, I’m reminded that mortgage individuals have no idea exactly what a beneficial lender actively seeks when they determine your home application for the loan. Very, You will find damaged it off right here.

After you apply for home financing, you might be essentially inquiring a lender so you can top the money to help you buy a house or apartment and you are asking these to invest in so it to possess twenty five-three decades.

Really home loans are not kept for that enough time, however your lender has to suppose you are going to wait, and so they could need to establish it to help you regulatory government, including the Australian Prudential and you may Regulating Power (APRA).

Around Australia’s in charge lending obligations, it imagine most of the application cautiously. The Australian Bonds and you can Money Fee (ASIC) likewise has statutes as much as in control financing.

The latest Four Cs off Credit

Capacity: would you pay off your residence mortgage? Are you experiencing a steady employment and you may constant money? Do you have other debts?

This last part takes into account the value of everything you own, and the value of everything you owe. The difference between these two numbers is your websites really worth .

Income

Bonuses, overtime, or other even more shell out carry out count but they truly are assessed in another way from the for each lender. Often, the loan review tend to legs such wide variety with the average out-of that it earnings over a couple of years.

In the event the income mode a major part of your revenue, definitely work at an agent who understands this. Some lenders do not let profits so you can matter once the income, specific only count up to 80% of complete earnings, although some will require it all. Good agent knows the best place to bring your mortgage having a knowledgeable danger of victory.

Side-hustles aren’t will addressed just like the regular income, if you don’t can be consistent money more a set period and even after that, just a few lenders encourage this while the income that matters on your own credit skill.

Leasing income is normally taken at the 80% of your actual earnings it utilizes your own bank. Short-title accommodations instance AirBnB might only feel determined in the fifty%, and lots of lenders won’t undertake it income anyway.

Although some nations is treated in a different way away from others, overseas money is usually deal otherwise forgotten. Consult your agent to find out more.

Be aware: Self-working someone deal with far more analysis from lenders and will need certainly to let you know he has got a constant earnings shown by the several consecutive many years away from team taxation statements. It can be easier to show your income in case the team https://clickcashadvance.com/payday-loans-il/ will pay your an appartment, steady wage.

Employment Background

Uniform employment background is very important particularly if you have been in identical, otherwise comparable, positions for a long time.

Top hustles (as mentioned significantly more than) are not generally speaking believed steady money and lots of loan providers has actually strict rules with respect to next perform. However, it is far from impossible to understand this earnings provided. Talk to a talented broker that will understand intricacies.

Offers

A reputation rescuing your revenue explains is also manage currency; web browser you’ve got extra money to arrive than just fun.

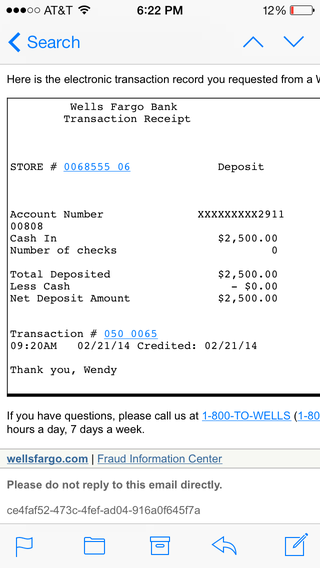

Bear in mind: In the event your lender looks at the deals, they appear during the normal deposits starting your bank account in order to establish your debts. A sudden lump sum deposit (for example from your tax reimburse, inheritance, or an economic current), isnt usually regarded as discounts,’ while the there’s no proof you have based so it upwards on your own.