If you are looking to get a property from inside the Arizona, D.C., you will find big down payment guidance compliment of one or two secret supply: the DC Casing Money Agency (DCHFA) as well as the Agency regarding Construction and you will Neighborhood Development (DHCD).

These types of organizations offer down payment and closing rates recommendations, aggressive home loan financial support choice, and you may info as a consequence of programs such as for example DC Open Doorways and also the House Pick Guidelines Program (HPAP) making homeownership alot more possible for anyone and parents on Region off Columbia.

You can buy a no-desire financing for up to you would like for your off payment from DCHFA’s personal loans online New York DC Discover Gates program.

The new DAPL was prepared so individuals aren’t required to generate monthly installments. New installment of the financing, that’s attract-totally free, is born completely not as much as specific criteria: when 3 decades has passed just like the loan’s closure day, if your property is sold or directed, should your property is not the latest borrower’s number 1 quarters, or if this new borrower refinances its first-mortgage.

DCHFA Financial Credit Certificate

Concurrently, if you meet the requirements, you are qualified to receive a good DCHFA Financial Borrowing from the bank Certification (MCC), hence entitles one a national tax credit comparable to 20% of the mortgage appeal you have to pay yearly.

The fresh new DHCD offers very first-big date home buyers having lowest in order to modest income assistance with its advance payment and you may settlement costs through its Home Get Direction Program, called HPAP.

- Low-earnings applicants generating below 80% of urban area average money can be found doing $4,000 given that an interest-100 % free financing without monthly premiums, due through to resale otherwise refinancing of the house.

- Moderate-earnings candidates earning 80% to 110% of your own urban area median earnings are eligible to possess a $4,000 attention-100 % free financing, repayable once 5 years.

DHCD Workplace-Aided Homes System (EAHP)

The fresh new Workplace-Aided Construction Program (EAHP) supports qualified Section government group having purchasing the basic unmarried-house, condominium, or co-op on the Region. It includes good deferred, 0% interest mortgage near to a corresponding finance offer, which you can use to have down payment and you will closing costs.

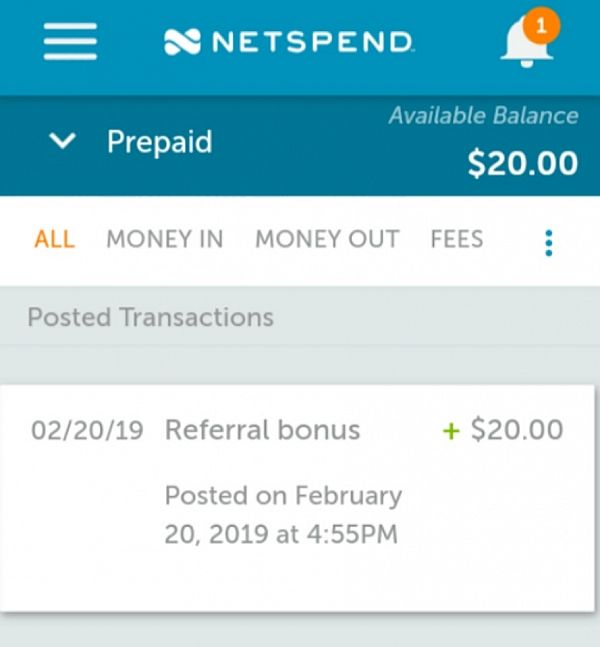

- The most loan amount might have been raised to help you $20,000.

- New complimentary financing give has been increased to around $5,000.

- A good recoverable give of up to $ten,000 exists for downpayment recommendations, contingent through to an excellent four-season services responsibility.

- The property have to are new participant’s dominant house for 5 decades, satisfying a beneficial four-12 months service agreement signed abreast of buy.

- Incapacity to meet up this type of conditions transforms brand new $10,000 give toward an excellent deferred, zero-appeal mortgage.

- Eligible for a matching loans grant as high as $fifteen,000.

Given that mortgage was good deferred second financial, zero repayment is needed if you don’t promote, refinance, if any expanded invade the property as your top residence. You will find info to the EAHP site. To see among the numerous DPA software towards the HUD’s webpages. step one

This new Fl Property Loans Enterprise (FHFC) try an option investment and you can a consumer’s first stay in Florida. Having apps eg downpayment guidance, low-interest finance, and homebuyer training, FHFC plays a crucial role in aiding Fl earliest-go out homebuyers.

Florida Help

The Fl Assist try a deferred second mortgage which have a good 0% interest as much as $10,000 which can be used to possess a down payment, closing costs, or both. The borrowed funds does not have any monthly premiums which will be paid down only when you offer, re-finance, otherwise pay off the first mortgage.

Fl Homeownership Financing Program (Florida HLP)

This new Fl Homeownership Mortgage Program (Fl HLP) is made to provide eligible first-date home buyers which have as much as $10,000 to use with the their down payment and you will settlement costs.