Your own USDA financing settlement costs shelter the various expenses which come having running a residential property. In this post, there is an in depth summary of these types of costs.

Purchasing a home is a significant financial decision. There can be almost nothing better than living in an area you to your phone call their. And since construction opinions fundamentally raise over the years, you can consider it because the an investment. But for that buy property, you need to sometimes possess money on hand or perhaps be entitled to home financing, each of that’s difficult to rating.

When obtaining a loan from a timeless financial like an effective bank, you will see your and you can financial recommendations scrutinized. If there is even a factor that will not meet their standards, the lending company might automatically refuse the application. Exactly how would you pay for a property instead boosting your earnings by the a great amount?

Bodies organizations for instance the USDA keeps mortgage applications which help basic-date customers with lowest-to-average revenues to find a property into the a rural area. In this post, you will observe exactly about brand new USDA financing:

- What it is

- Who is eligible

- Do you know the USDA mortgage settlement costs

- How-to buy the USDA loan closing costs

What exactly is a great USDA Financing?

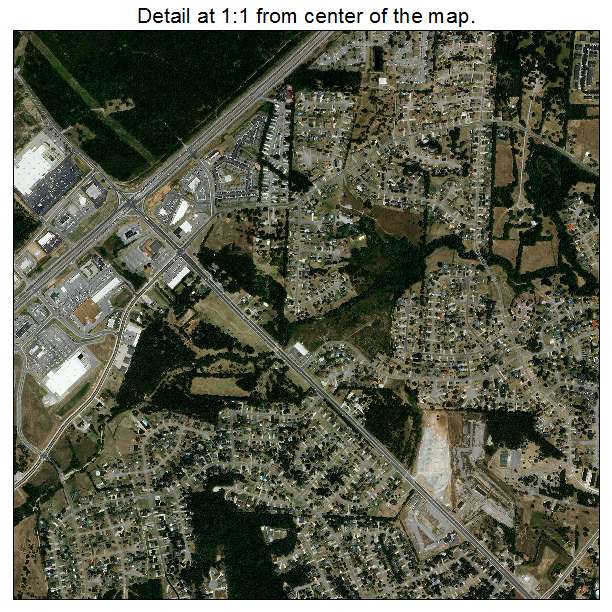

A USDA financing is actually a home loan program offered by this new Joined Says Agencies out of Farming (USDA) through private loan providers. It has advantages for earliest-date homeowners who wish to buy property for the a rural area, that’s 97% of your own country’s landmass.

Which bodies system provides affordable homeownership chances to reasonable-to-moderate-money domiciles. The brand new USDA hopes you to through providing an inexpensive loan so you can homebuyers who want to live-in an outlying urban area, they can turn on the brand new savings in these communities.

The newest USDA financing enjoys a make sure allows lenders when deciding to take on the a lot more exposure and supply qualified homebuyers greatest rates and you can words. Check out of your own mortgage experts your system also offers:

$0 Deposit

The very best good reason why of several have not bought a house is because they are rescuing upwards toward 5% to 20% down-payment. Of several parents cannot even manage so it.

The newest USDA loan is amongst the last left $0 down-payment home loan possibilities. The main one caveat is that you have to get a house during the an outlying town. Services during the places and you may nearby groups are not eligible.

Aggressive Rates

The USDA brings a hope in order to loan providers for them to promote all the way down rates so you can homebuyers just who acquire this choice.

Real pricing are different with respect to the private financial, your credit score, together with current market criteria. But you’ll see a big difference when comparing the interest prices that have the ones from traditional finance.

Low Monthly Mortgage Insurance rates

Once you sign up for a conventional mortgage but you should never appear having a beneficial 20% down-payment, lenders requires that pay money for individual financial insurance policies (PMI). This fee can range away from 0.2% to 2.15% of the total financing that you’ll either need to pay upfront, per year, or four weeks. With regards to the lender, paying for your own PMI ends up when your loan-to-value proportion are at 80%.

-

installment loans Pennsylvania

- An initial commission one to will cost you step 1% of your complete funded count, which you pay when you close toward loan or keeps they included in your full.

- Annual fee well worth 0.35% of the loan’s most recent equilibrium, which you’ll partly spend a month.

Versatile Borrowing from the bank Conditions

Really traditional loan providers need you to has actually a credit history out-of at the very least 640 to use, however you should have on the 720 or more to qualify to possess straight down interest levels.