In this situation, the first financing was paid, making it possible for the next loan are composed, in place of only while making a separate financial and you will throwing away the totally new home loan.

For individuals with the greatest americash loans Murray credit history, refinancing is going to be a sensible way to transfer a variable financing speed to a fixed, and acquire a lowered rate of interest.

Usually, once the some body sort out its work and you can continue steadily to generate a great deal more currency they can pay all their expenses timely meaning that enhance their credit rating.

With this particular increase in borrowing happens the capacity to procure fund on down pricing, and therefore a lot of people refinance and their finance companies for this reason.

Pre-buy will cost you out-of a home buy as a consequence of home loan can total right up to 29 per cent of your own property’s really worth Picture Borrowing: Shutterstock

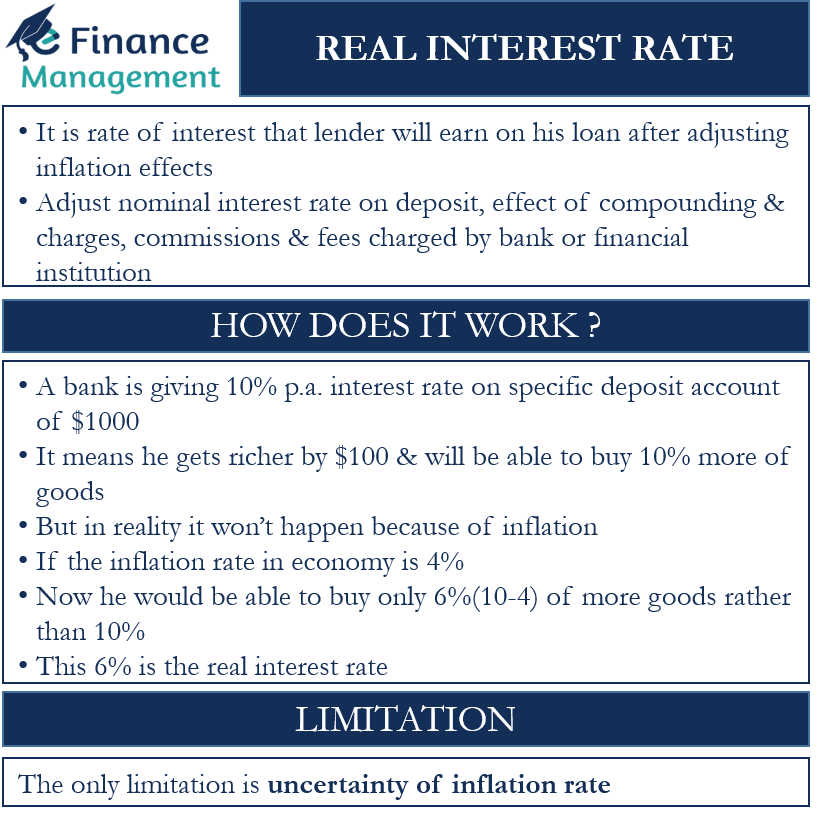

A diminished interest rate may have a profound effect on monthly repayments, potentially saving you numerous dirhams annually.

Less rate of interest can have a deep impact on monthly money, potentially helping you save numerous dirhams per year.

Without proper knowledge, although not, it can in fact harm that re-finance, boosting your rate of interest unlike reducing they.

Cash out family guarantee: Property owners normally pull equity throughout the homes. Should your guarantee was removed to fund family repairs or big home improvements the eye expense may be tax deductible.

Transform mortgage stage: Reduce duration to pay reduced interest over the life of the fresh new financing and individual your house outright faster; prolong the duration to lower monthly premiums.

Can NRIs avail that it business?

NRIs can also be re-finance the personal debt-totally free qualities in the India. In reality, the process having choosing financing facing a home doesn’t differ a great deal for a keen NRI and you will a resident regarding India.

So long as an enthusiastic NRI owns a domestic otherwise industrial possessions within his or their unique title, that individual can simply borrow against their possessions.

The method having availing financing facing property does not are very different much getting an NRI and you can a citizen out of India.

But there are a few constraints in order to how much cash are transferred, availed or lent, and possess perquisites towards minimum money demands.

Constraints when credit up against financial obligation-free possessions for the India

Funds can simply end up being produced from all in all, a couple functions, which happen to be susceptible to fees. Additionally there is a restriction on the matter and this can be transmitted, which is to $250,000-a-individual (Dh918,262) a year.

The minimum it’s possible to borrow secured on any assets quite often, whether you’re a keen NRI or perhaps not, are INR five-hundred,000 (Dh 24,292), since the restrict was INR fifty million (Dh2.4 million).

The loan count can move up in order to INR 100 billion (Dh4.nine mil), according to the fees strength, and area the spot where the loan is actually disbursed.

Fund can only just feel produced from a total of a few functions, being at the mercy of fees.

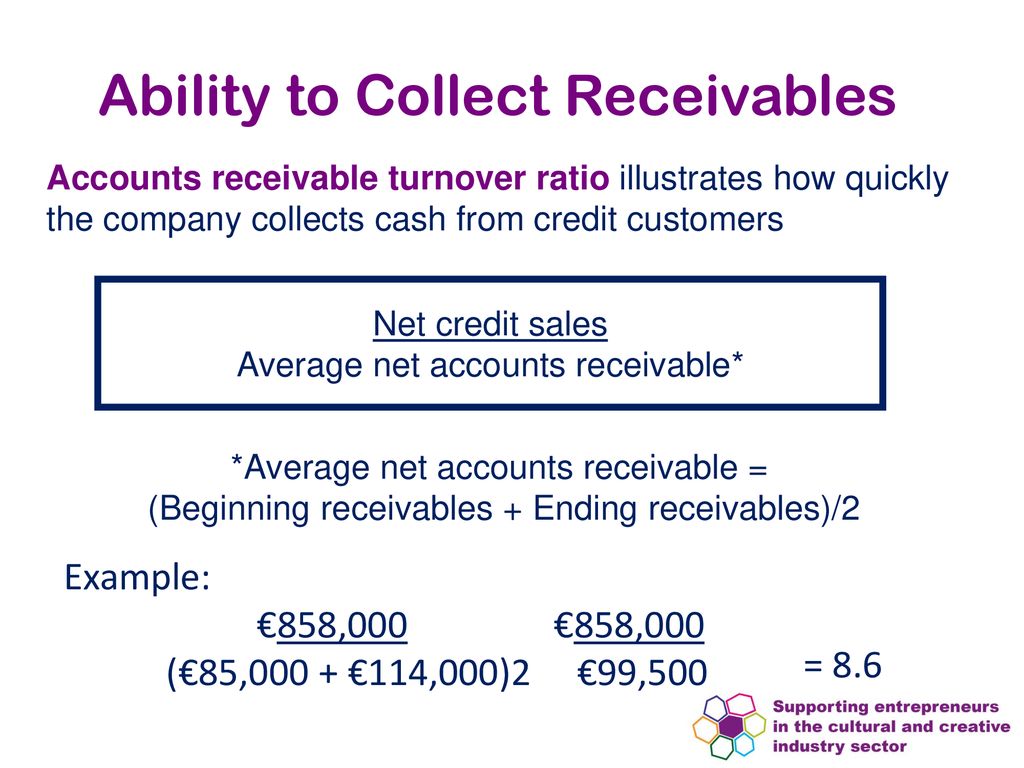

Extremely loan providers usually offer money anywhere between sixty-70 percent of your own market price of your property (loan-to-worthy of proportion) and that’s offered only most of the time so you can salaried NRIs.

However some lenders perform avail 80 % LTV, there may be others that provides merely forty-50 % LTV of your own house, which is at the mercy of your earnings eligibility.

LTV proportion is actually high to possess financing drawn up against house, whenever you are LTV ratio is low for financing facing commercial assets.

LTV in addition to depends on occupancy. According to investigation off Deal4loans, usually, this new LTV ratio to possess a home that is worry about-occupied, was 65 % of their market value.