Focus on cost management. You simply will not possess disposable money while you are when you look at the repayment, making this the amount of time to hone the cost management process. Are a cost management whiz now can help you stop getting into more your head once again later on.

Consider a protected cards after payment. Before you go, a secured mastercard makes it possible to rebuild shortly after bankruptcy. You can spend the money for mastercard organization in initial deposit, that’ll including act as the paying restriction. Which have in charge have fun with, you ought to visit your score boost.

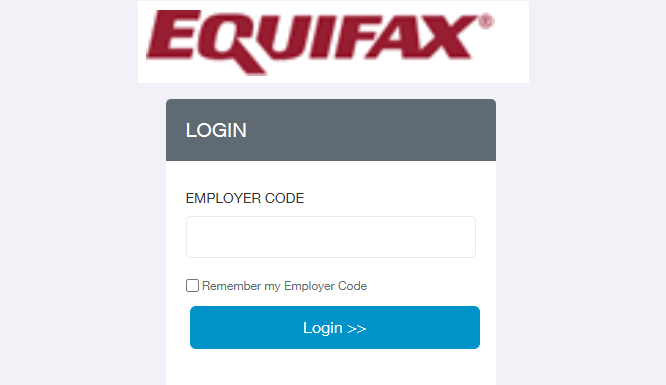

Keep an eye on your credit score. Watching your credit rating rise because you make wise choices can be help you stay the category. Get totally free credit rating with LendingTree Springtime. We’ll together with make you individualized borrowing from the bank expertise, alert you if for example the score alter and much more.

Chapter 7 bankruptcy proceeding

Chapter 7 personal bankruptcy (labeled as liquidation case of bankruptcy) is the most common sorts of personal bankruptcy. But in place of Chapter 13, it will take you to promote specific property.

Not everyone qualifies getting Chapter 7. In the event the earnings is higher than new average on your county, you need to just take a means try. This attempt demonstrates into legal that, according to your earnings and you can current deals, you simply can’t be able to pay what you owe.

Debt consolidation

Debt consolidation reduction just is practical if you possibly could afford to spend your balance. Consolidating doesn’t eliminate your debt, they reorganizes it.

Using this, you are able to sign up for a debt consolidation mortgage and use it so you can pay off your funds and you will handmade cards. Upcoming, in lieu of expenses several loans expenses, it is possible to just have that costs to pay – your own integration financing.

Combining might also save you money on the appeal if you have increased your credit score due to the fact taking right out the unique fund. And additionally, debt consolidation fund generally speaking include down prices than simply credit cards.

Personal debt government plan

When you’re as a consequence of mandatory borrowing guidance, their therapist you are going to offer an obligations government plan while the a keen replacement bankruptcy proceeding.

A financial obligation administration package really works a lot like Chapter thirteen, nonetheless it ought not to container your credit score. You will have three to five decades to repay your debt (within the entirety). Their credit specialist might get your all the way down rates of interest by settling along with your financial institutions. And you will such as for instance a great trustee, they’re going to handle your repayments.

Faq’s

So you can document Chapter thirteen, you can easily spend good $235 instance submitting commission and you can a great $75 miscellaneous payment, to possess all in all, $310. A bankruptcy proceeding, at the same loans in Sawgrass time, can cost you $335 (a $245 submitting fee, a $75 various government percentage and you can a great $fifteen trustee surcharge).

not, specific A bankruptcy proceeding cases require you to sell-off particular assets to pay for your debt. Part 13 doesn’t. Attorney can cost you are very different and so are perhaps not incorporated.

How much time can it take to own Part 13 to be approved?

It will take around 75 weeks for the courtroom to help you agree the Section thirteen bankruptcy proceeding instance. Immediately following you are approved, you have three to five decades to pay off your qualified debt.

Must i continue my checking account if i document Part 13?

Yes, you can keep your finances unlock for those who document Part thirteen. It is possible to manage to remain some of the loans which can be in your membership, should they was factored into the fees package. The fact you don’t have to liquidate their possessions is actually one of the biggest advantages of Chapter thirteen.

Note that you can find exclusions to that particular rule. Specifically, when you’re in financial trouble towards the financial that can has your account.

You don’t have to rating a lawyer, but that doesn’t mean it is preferable so you can represent oneself. Bankruptcy laws is challenging, and you may want some help from an expert.

It’ll take the time to get accustomed to existence immediately after bankruptcy proceeding, however commonly fundamentally destined having less than perfect credit permanently. Below are a few tips that could help you jump right back.