Display

Selecting home financing can be stressful, even when the borrower knows just what a mortgage are and just how one to performs. With many lenders competing for their company, borrowers can certainly become overwhelmed of the their choices. If the a borrower is actually evaluating Quicken Funds against. Skyrocket Financial, they’ll be happy to know that each other brands relate to the newest same business-hence organization now offers a completely on the web mortgage procedure that can make providing financing quick and easy.

Of several users question, Is Skyrocket Home loan a? Since the perfect respond to is determined by brand new borrower’s particular means, Rocket Home loan is called among the best lenders to have basic-go out consumers and you will seasoned consumers equivalent. Their easy on the web mortgage processes and you will total positive customer analysis back-up the company’s dedication to deciding to make the domestic- financing processes an easy one to.

step 1. Quicken Loans and you can Skyrocket Home loan are exactly the same providers, however, that was not always the truth.

When you find yourself both Skyrocket Financial and you will Quicken Financing is actually recognizable brands inside the the loan business, most people are not aware that they are in fact one in addition to exact same. Although not, the history of providers may a little perplexing.

Stone Economic, a large financial company, is founded during the 1985 because of the Dan Gilbert and you can became a home loan financial for the 1988. Gilbert’s goal was to make clear the borrowed funds process getting people-before web sites is popular, this intended emailing mortgage data files so you can customers so they really you will sign all of them in the home. But this Home loan within the a package was just step one on the an extremely simplistic mortgage process.

From inside the 1998, Gilbert emailed their personnel discussing that his eventual purpose would be to place the entire home loan process on the web. Due to the fact internet was still wearing grip to your standard inhabitants, so it goal likely appeared like an extend during the time. But Material Monetary began personal loans Kingston Ohio taking care of doing this mission, and RockLoans revealed when you look at the 1999-this is the start of the company’s electronic home loan company, designed to bring a simple and process getting customers. A year later, during the December 1999, the business was ordered by the Intuit and you will was renamed because the Quicken Finance. It purchase is short-lived, even though, once the Gilbert and many private traders purchased Quicken Financing back out of Intuit from inside the 2003, sustaining the fresh marketing and marketing of providers. Eventually thereafter, QuickenLoans was released to assist provide individuals that have on the internet gadgets instance just like the a fees calculator an internet-based financial app. By the 2010, Quicken Loans designated a primary milestone of the closure their step one millionth loan.

dos. Quicken Funds launched new Skyrocket Home loan brand name during the 2015 to deal with their digital mortgage providers.

As the Quicken Loans’ electronic mortgage business went on to enhance, the firm decided it necessary to lay more of an attention thereon aspect of the team, and that triggered the development of Skyrocket Mortgage.

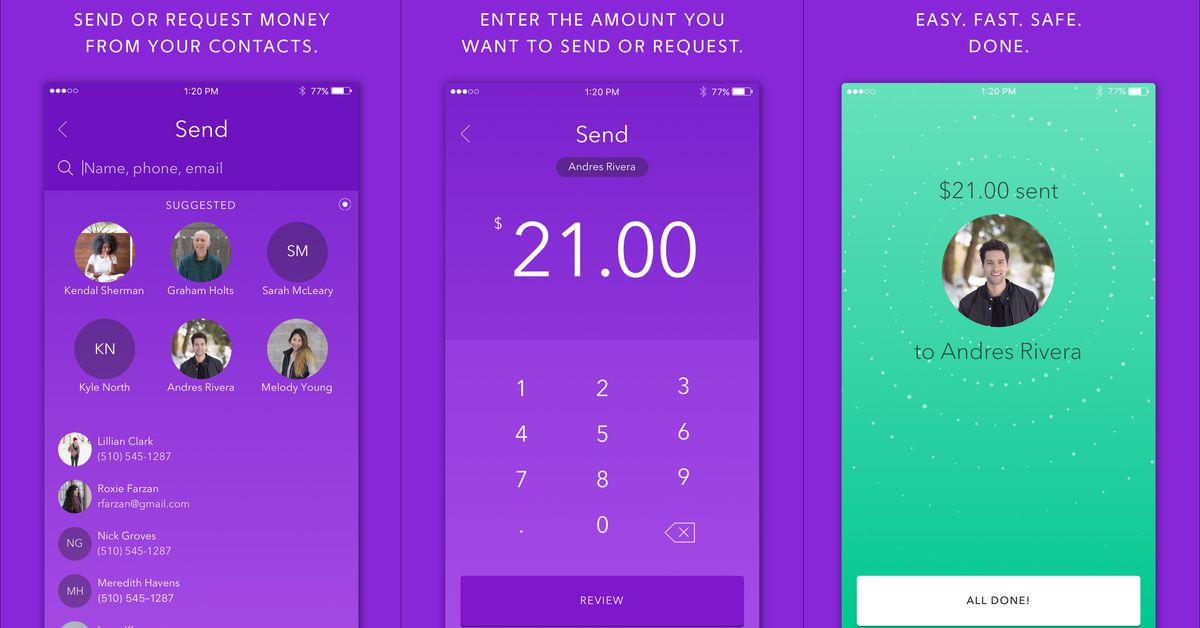

Skyrocket Financial was developed inside the 2015 due to the fact a subsidiary from Quicken Loans-one which manage handle 100 percent of your businesses electronic financial providers. Having fun with Rocket Financial, consumers could glance at the whole mortgage techniques-off preapproval so you can closure-without going feet within the a brick-and-mortar area or enjoying financing administrator really. If in case they still desired a far more traditional sense, they might choose get their home loan using Quicken Money alternatively.

step 3. Skyrocket Home loan try the original lender to add a totally electronic an internet-based financial feel all the time.

Today, of several people expect to have the ability to manage their mortgage and other finances entirely on the internet, but one to wasn’t always the truth. Actually, Skyrocket Financial try a pioneer on digital home loan community, paving just how to many other loan companies to check out fit. As opposed to the conventional mortgage techniques, Rocket Mortgage promised a good 100 % digital mortgage feel, with consumers in a position to over all elements of the mortgage procedure from her house. While many consumers today almost assume most of the financial strategy to end up being electronic, technology to make it happens did not exists before Skyrocket Financial.