To find a house can appear for example an intricate techniques, especially if you is actually an initial-date client. To order a property isn’t as as simple searching for your ideal family offered, composing a, and you may moving in. Even when industry issues imply its a client’s industry, it is usually smart to do your research and you can proceed very carefully. Whatsoever, buying a property is among the most significant investments you’ll actually ever make. For this reason prior to taking the latest dive into the basic home, you really need to devote some time to review numerous items, and additionally what your economic health turns out, how much cash you really can afford, and exactly how far you may have set aside to own a deposit. Purchasing property is a significant connection, but sooner its a worthwhile resource for the upcoming.

All things considered, listed below are some smart motions and information you need to use if you find yourself you are preparing to purchase your basic family.

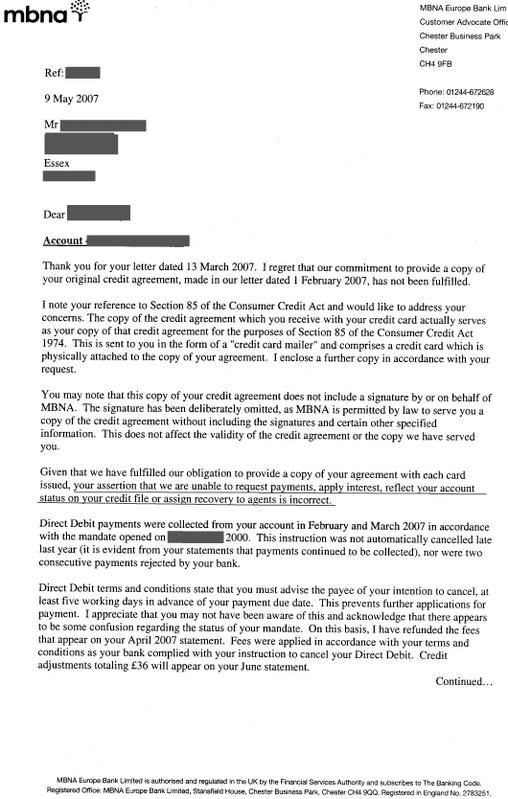

While the an initial-day buyer, the first step you need to is to try to look at your current credit score. Wearing an understanding of your credit report can not only help your improve your credit score throughout the years, nevertheless will also help you in other aspects of existence. Loan providers look at your credit history to greatly help see whether you is qualify for a home loan and you can what interest rate they are willing to https://paydayloanalabama.com/hackleburg/ offer. In the event the credit score is on the reduced avoid of your measure, their rate of interest can be high, so you will likely end up spending far more on the home finally. Good credit makes it possible to safer a reduced interest and in the end down home loan repayments.

Check your credit reports with all of about three organizations (Equifax, Experian, and TransUnion) to see your local area already, and then you may start when deciding to take actions to switch the get.

2. Begin Preserving Very early

Mortgage off payments will start out-of 5%, with choice even offering no down payment. The newest 20% advance payment that you might usually hear ‘s the practical lowest while the lower than you to amount can get hold an additional fee every month into the the type of Private Financial Insurance (PMI). Lenders fool around with PMI to safeguard by themselves should you default on the the loan, not you will find first-date homebuyer apps that actually offer both no down payment and you may zero PMI. Either way, its required to has actually more on the discounts inside introduction for the down payment. The additional money assists you to pay money for the other not-so-apparent costs to homebuying, along with settlement costs, assessment fees, all about home inspections, swinging costs, and you can unexpected family fixes and you will enhancements.

step 3. Repay Small debts

To shop for a home is actually a substantial investment decision and you may an funding on the upcoming. Their mortgage repayment often effect your loved ones cover ages in order to become, however, because your monthly installments wade directly to your residence financing, you will be able so you can enjoy monetary professionals down-the-line. Whenever loan providers consider carefully your mortgage app, they check your financial obligation-to-money (DTI) proportion to ensure you could potentially handle the loan costs and ultimately pay-off the loan.

Repaying as often loans as you possibly can before applying for a home loan can assist change your credit history and reduce the DTI proportion, improving your possibility of qualifying having a mortgage loan having a great price.

cuatro. Dont Skip Preapproval

Even though it is tempting to help you plunge directly into our home-search procedure, bringing an excellent preapproval letter beforehand looking is essential. A home loan preapproval is actually evidence of simply how much a loan provider was happy to loan you to definitely buy a property, plus it traces the regards to the mortgage. With a preapproval at your fingertips will change your standing having manufacturers by the showing them you will have the amount of money available to create the acquisition causing them to more likely to deal with your own bring.

Also, you’ll have a better comprehension of just how much household you can afford after you have a good preapproval. This will help to prevent you from falling in love with a home beyond your financial allowance. Additionally, you happen to be less likely to find past-second waits otherwise problems with your financial which could impression your own power to complete the purchase.

5. Work on a realtor

It could be appealing in order to forego coping with a realtor. Whatsoever, owner probably has their particular representative. Yet not, getting a good real estate agent offers you a sizeable advantage when household query, specifically for basic-date consumers. Real estate professionals has actually an unmatched comprehension of the fresh housing industry and can assist you in finding a house on your own spending budget that meets any preferences.

Furthermore, a realtor can help you negotiate the purchase price, closing conditions and you can walk you through the purchase processes. Which professional advice can help you get a better offer than just your probably have obtained yourself.

6. Hire an Inspector

Purchasing a home was a costly techniques, out of home loan software charges in order to courtroom and you can closing costs. So, why must your hand more hundreds significantly more having a home check?

A good household assessment enables you to realize about their possible the fresh house’s major and lesser facts before buying it. It certainly makes you aware of what will cost you, solutions, and maintenance our house will demand immediately or even in the close future. An examination may also find out probably life-threatening affairs eg shape and awry cables. As well, most lenders need a house inspection becoming did as an ingredient of financing terminology. This condition covers you and the financial institution from the guaranteeing indeed there are no major otherwise high priced problems that could hamper what you can do to repay the borrowed funds. Delivering a house examination offers your with a way to straight back out from the render to acquire if you aren’t safe for the inspector’s conclusions.

Get your Very first House or apartment with Community First

Society Very first Borrowing from the bank Partnership enjoys a team of financing pros in order to make it easier to throughout the to invest in processes regarding preapproval so you’re able to closure. Learn about the Very first-Go out Homebuyer Program otherwise call us to begin with on your own real estate trip today!